Independent Retirement & Investment Planning

At Compound Wealth, we provide independent retirement and investment planning for clients who value structured advice and a long-term approach to building and protecting their wealth.

Based in Mount Maunganui, Bay of Plenty, we work with clients across New Zealand to design integrated strategies that align investments, KiwiSaver, and long-term cash-flow planning with the decisions that matter most over the next 10–30 years.

Our advice is planning-led, not product-led. Whether you are approaching retirement, restructuring investments, or managing a significant pool of capital, we focus on clarity, portfolio structure, and disciplined decision-making over time. Where appropriate, this includes high-end KiwiSaver strategies and access to open-architecture investment solutions offering greater flexibility, diversification, and control.

If you are seeking an ongoing adviser relationship and a more intentional approach to retirement and wealth planning, we invite you to book an initial conversation.

Now advising on over $130m for clients nationwide

Our Tiered Packages

KiwiSaver Switch

Our partners

Independent KiwiSaver, Investment & Retirement Advice

We provide independent KiwiSaver, investment, and retirement planning advice for Kiwis who want clarity, control, and better long-term outcomes.

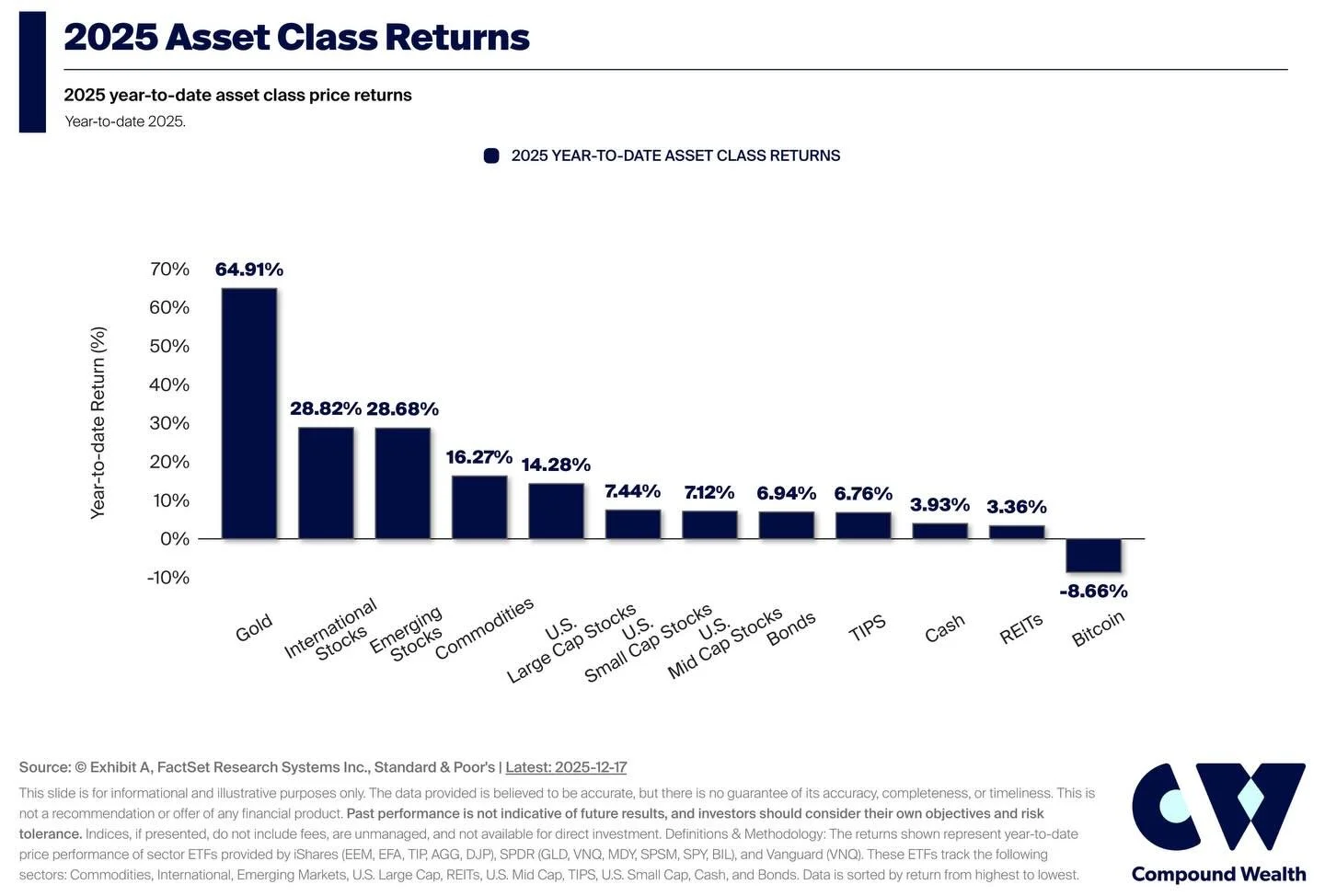

Unlike banks and provider-owned advisers, our advice is open-architecture and unbiased. We’re not tied to any one KiwiSaver scheme or fund manager, which means we can compare options across the market and make changes when more suitable solutions become available. Every strategy is designed around your goals, risk tolerance, and time horizon.

Whether you’re reviewing your KiwiSaver, investing a lump sum, or planning for retirement, we combine structured financial planning with a best-of-breed investment approach, selecting high-quality managers with a clear role within a diversified portfolio.

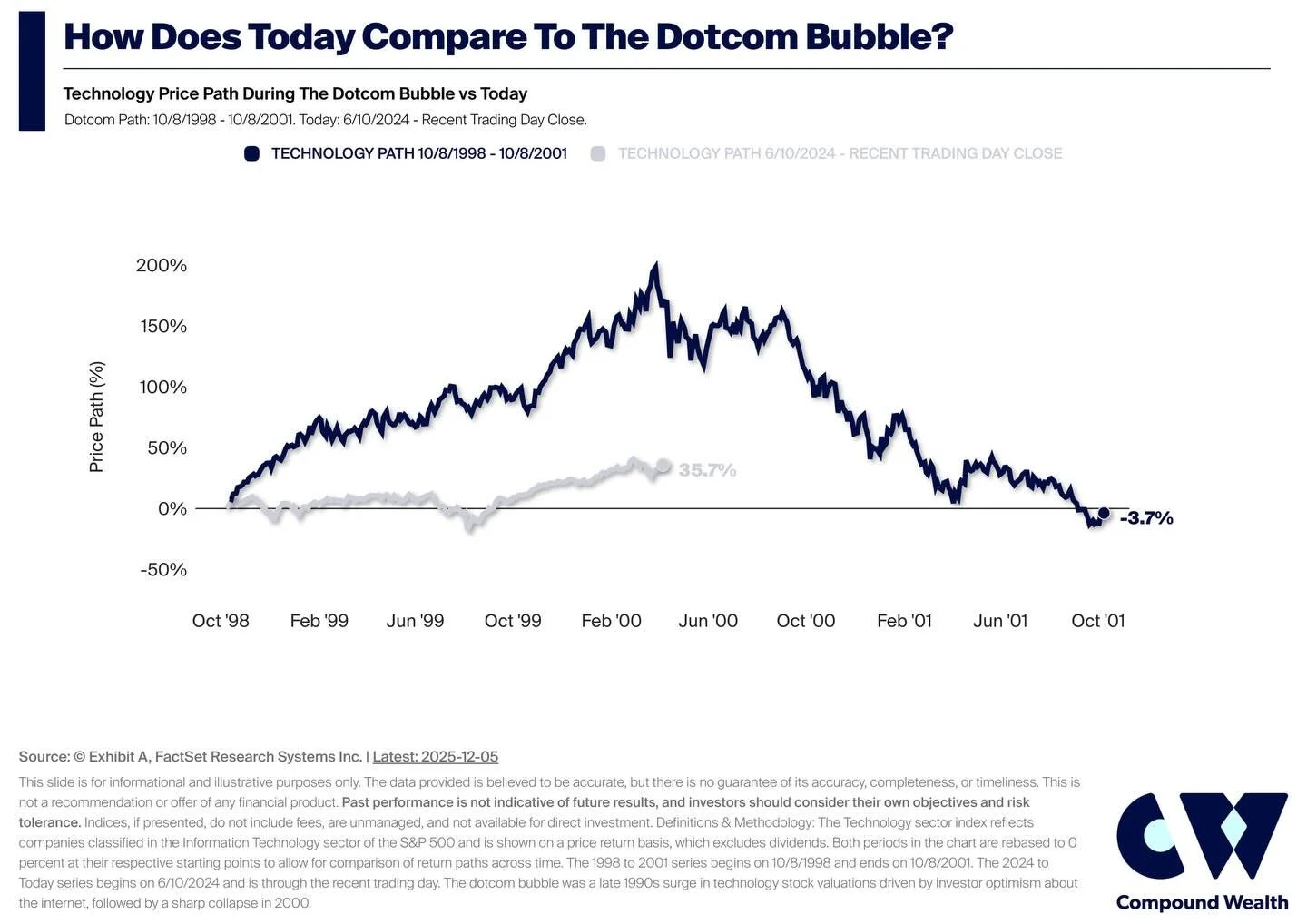

Using detailed cashflow modelling and long-term projections, we help you understand where you’re heading, what’s realistic, and how your investments work together over time, then put a clear strategy in place to keep you on track.

Since 2017, we’ve helped hundreds of clients make better investment decisions, select appropriate risk levels, and transition away from unsuitable or underperforming strategies into more appropriate, well-structured portfolios aligned with their long-term retirement goals.

Book an initial consultation to see whether your current KiwiSaver and investment strategy is set up properly for the years ahead.