Term deposits are paying 6%, should I abandon my investment strategy?

Post originally written and shared on 17 January 2024 by Ben Brinkerhoff, Head of Advice at Consilium

A question being asked by some investors today is whether they should change their investment strategy because term deposits are paying 6%. Their logic goes something like this:

“When I look back on the last few years in my portfolio, I haven’t earned close to 6%. If I can get 6% in term deposits that’s a higher return with more safety. Why wouldn’t I do that?”

Although term deposits (TDs) are more attractive than they have been in a while, here are seven simple and compelling reasons to stick with your diversified investment strategy.

1. While your portfolio may have performed poorly, so have TD’s.

TDs provide a feeling of safety but it’s artificial. Because TDs can’t be traded, you can’t see their price fluctuate. If TDs were tradable, you would have seen that your TD’s have lost a lot of money recently, just like the bond portion of your portfolio. In Jan 2021, you could buy a 5-year TD for a locked in interest rate of about 0.95%. In Jan 2024 (3 years later) you can get an equivalent 2-year TD from the same bank at 5.15%. Just to be clear, a 5-year TD purchased three years ago is the equivalent of a 2-year TD available today, if it’s from the same bank.

If that 5-year TD could be sold on the open market, what would its price be? Answer: it's price would have fallen by 7.8%. In other words, if you bought the TD for $1,000 three years ago, you could only sell it for $914 today. And that makes perfect sense. Who would purchase a TD from you with a rate of 0.95% when they can get a new one from the same bank for 5.15%? The only way you'd be able to sell your old TD is if you lowered its price until a buyer was indifferent between buying yours at a discount or buying a new one from the bank with a larger interest payment.

Importantly, what this shows is the idea that TDs are “safe” is misconstrued. They aren’t safe, they just can’t be sold so their price volatility is hidden. But here’s the reality, if you’ve owned your portfolio for three years and you are doing better than –7.8% then you’ve outperformed the equivalent of holding long dated term deposits.

2. Comparing your backward-looking portfolio return to forward-looking TD rates is flawed.

You should only compare your portfolio’s past performance to what an equivalent TD investment would have delivered over the same time period.

Nearly all investments have had a difficult three years. However, while TDs are looking much better now, so are portfolios. Interest rates on TDs are much higher than they’ve been recently. But the bond funds in your portfolio are earning more too.

For example, the Harbour Corporate Bond Fund has a yield to maturity (a concept roughly similar to the fixed interest rate on a TD) of 5.75% as of November 30th (the most up to date figure available at time of writing). TDs with a similar average holding period as of the end of November were paying about 5.3%. At the same time, longer dated TDs had an interest rate of around 5.15%. But longer dated bond funds like the Dimensional Global Bond Trust, at the end of November had a yield to maturity of 5.50%. So bonds, in general, are paying higher interest than TD’s. In summary, on a forward-looking basis, if you think it’s a good time to buy TD’s, then it’s also a good time to buy bonds.

3. Bonds have several other advantages over TD’s.

Firstly, they can be sold at any time at an extremely low cost. Investors that may want to make regular withdrawals or to save on a periodic basis can understand the simplicity of buying and selling bond funds in a portfolio. Some banks charge 1%, 2% or more to sell TD’s and a lead time of at least a month to get your money.

Secondly, bond investors using PIE (Portfolio Investment Entity) managed funds get taxed at a maximum rate of 28% compared to a maximum of 39% for holders of TDs, so bond funds are more tax efficient for high earners.

Thirdly, bond investors can easily diversify across different lenders. This provides additional protection against something going really wrong at a local bank. No one expects a bank to fail but it still happens occasionally (the most recent to hit the headlines was the failure of Silicon Valley Bank in the US in March 2023).

Diversification is your friend and bond funds provide you with vendor diversification from within your portfolio.

4. Putting everything into TDs is very likely to be sub-optimal.

Equally, except in rare circumstances, no financial adviser is going to recommend an investor go 100% into bond funds. There is good reason for this - a portfolio of only bonds or TDs will have trouble growing wealth over time.

Growing wealth over time is important in order to keep up with and/or surpass the rate of inflation and provide for your future spending needs. For example, in December 2022 you could buy a 1-year TD at a rate of 5.25%. After paying tax assuming a 33% tax rate, the net return was 3.52%. However, over the past 12 months inflation has been 5.6%. In other words, an investor in a 1-year TD saw the value of their wealth decrease by a little over 2% (3.52% return minus 5.6% inflation) over the past year.

That is no way to secure your financial future.

5. Over the long run, a portfolio can and will build wealth.

While TDs offer the appearance of stability, a portfolio holding regularly priced assets will go up and down in value. That’s the trade-off. You must be willing to accept some rough patches in your investing journey in order to keep up with and outpace inflation overall.

Over the past 12 months, a Synergy Classic portfolio of 70% shares had a return of approximately 9% before taxes but after investment fund fees. Even after accounting for tax and advice fees and other costs, that portfolio kept pace with inflation.

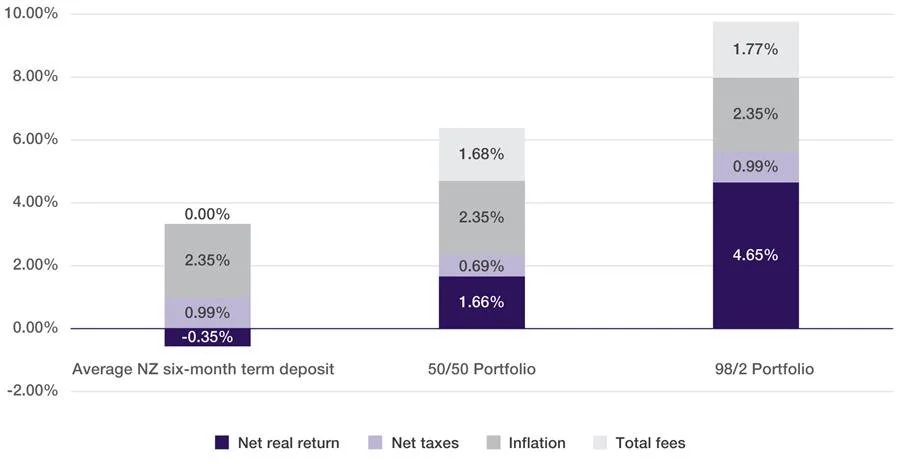

We aren’t simply cherry picking one year. Looking back over the past 10 years, the chart below shows that after all taxes, fees and inflation, portfolios have been able to grow wealth whereas term deposit investors have gone backwards. A portfolio of 50% shares and 50% cash and bonds had a return after taxes fees and inflation of 1.66%. A portfolio of term deposits (even though it paid no fees, hence the 0.00% above the bar) had a return after taxes and inflation of -0.35%.

Return January 2013 to December 2022 after all taxes, fees and inflation:

6. A portfolio is more likely, over time, to help you achieve your objectives.

Advisers don’t recommend a portfolio because they think you will like the price volatility. No one likes price volatility. The reason advisers recommend a portfolio is because a portfolio is more likely to increase the chance you will achieve your objectives.

Let's assume you have $1,000,000 and want to spend $40,000 increasing this amount each year by the rate of inflation. If you invest in a portfolio earning 1.66% above inflation (like the 50/50 portfolio did in the chart above), at the end of 30 years, you still have $100,000 left. If you invest in TDs and got returns 0.35% below inflation, you ran out of money six years early. The two outcomes are highlighted in the following graph.

Wealth over time — Spending $40,000 via a portfolio or term deposits:

This emphasises that the reason an adviser generally recommends a portfolio is because of its ability to grow wealth, and growing wealth matters to achieving investors’ spending and savings goals.

7. Advice matters.

This is one of the most important reasons why TDs are really not the best choice for the long-term investor – a portfolio is much more likely to be “advised”.

The best advice doesn’t merely cover whether you’ll outspend your money. It also covers how to make the best use out of your money along the way. That might mean advising you to spend more when you have good health, what to do with lump sums like inheritances, how to manage the sell down of the family home, where to seek aged care, how to help children when they ask for financial support, how to navigate new tax rates and structures, and many other topics.

But beyond even those issues advice provides peace of mind, knowing that you’ve explored your financial situation thoroughly, that you have a robust strategy in place, and you have someone looking out for your interests so you can focus on the things in life that matter most to you.

The purpose of this article was to summarise the reasons why sticking with your diversified investment strategy, even though TD rates now look more attractive, continues to make so much sense. We understand the appeal of something that appears safe. However, we encourage you to think carefully about this decision. Engage with your adviser, if you have one, and go through these seven points. If you are a long-term investor with a horizon stretching out for many years, you will most likely find that a portfolio is far better suited to your needs and lifestyle than a portfolio of TDs.

Are you interested in moving out of a term deposit and into an investment strategy? Please reach out to us today for a quick chat, or complete one of our quizzes below and we will be in touch to discuss your Investment, Retirement or KiwiSaver options.

Compound Wealth are based in Mount Maunganui, Tauranga and offer KiwiSaver, Investment & Retirement Financial Advice to clients all over New Zealand.