Compound Wealth Blog

Our bank of knowledge

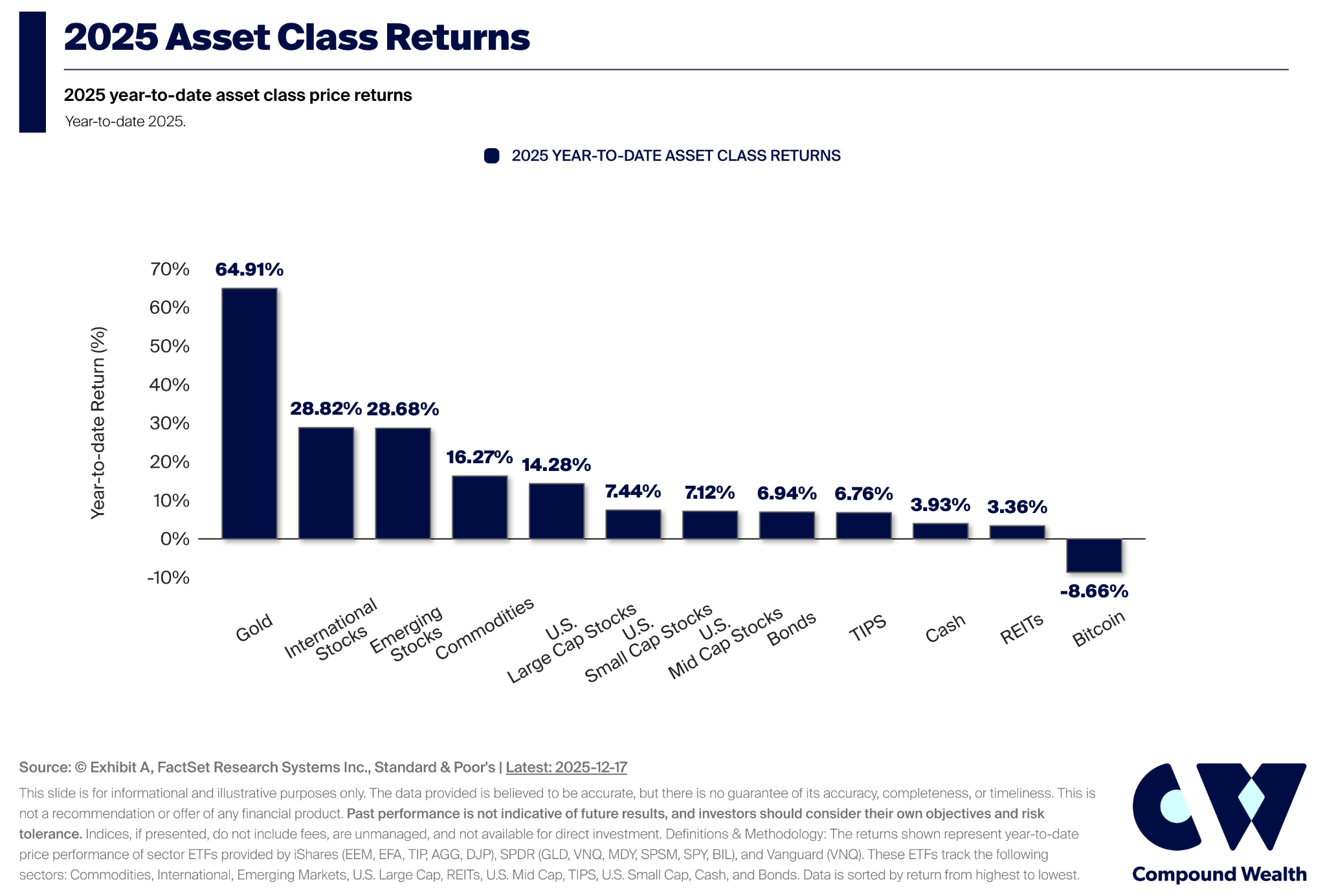

2025 Year-to-Date Market Returns: A Reminder of Why Diversification Matters

Below is a snapshot of year-to-date asset class returns for 2025 (to mid-December), which provides a useful lens on what has driven performance so far this year.

Why Staying Invested Still Wins: A Long Term Investor’s Guide to Market Noise

The best days in the market often occur very close to the worst days. Investors who try to time their exits are far more likely to miss those sharp recoveries.

What The New KiwiSaver Changes Mean For You

New KiwiSaver contribution rates are coming, and National wants to lift them even higher. This article explains what the changes mean, why tax settings matter more than most people realise, and how to build a plan that lets you retire on your terms.

Quarterly Market Update — September 2025

The September quarter was a strong one for investors, with global share markets continuing to march higher. Progress on US trade deals, renewed optimism around artificial intelligence (AI), and central banks shifting towards easier monetary policy all helped drive markets upward.

Despite ongoing political noise and slower economic growth in some regions, investors who stayed invested were well rewarded. For diversified portfolios, the combination of strong global equities and positive bond returns resulted in one of the best quarters in recent years.

How to Invest Your KiwiSaver in Gold and Silver

Many investors are turning to gold and silver to protect their wealth against inflation and uncertainty. Through the KiwiWRAP KiwiSaver Scheme, you can build a bespoke KiwiSaver portfolio that includes exposure to gold, silver, and other global assets all within a compliant, flexible structure.

Crypto Tax & KiwiSaver: What You Need to Know

What You’ll Learn

How the IRD taxes crypto in New Zealand

Simple record-keeping tips to stay compliant

What to do if you get an IRD letter or audit

How crypto can be added to your KiwiSaver through KiwiWRAP

Real case studies and examples from local investors

Best Performing KiwiSaver Funds in 2025 Mid Year Update

Maximise your returns for retirement with Compound Wealth’s list of the best KiwiSaver funds in each category for the first half of 2025. We help you decide how to invest.

Invest Your KiwiSaver in Bitcoin

At Compound Wealth, we can facilitate Bitcoin exposure inside your KiwiSaver if that’s your conviction. You choose the level of exposure from a target 30% sleeve to a high-conviction 99%. We simply structure and administer the portfolio through the KiwiWRAP KiwiSaver Scheme.

How We Use Independent Morningstar Research to Build Better Portfolios

Good advice should be backed by great research. That’s why we subscribe to Morningstar Adviser Research - a globally respected, independent research house that helps advisers like us cut through the noise and make evidence-based investment decisions.

Best Performing KiwiSaver Funds in 2025 - Q1 Update

Maximise your returns for retirement with Compound Wealth’s list of the best KiwiSaver funds in each category for the first quarter of 2025. We help you decide how to invest.

How Much Will I Have in KiwiSaver by Retirement?

How much you’ll have in your KiwiSaver depends on several factors, including your contribution rate, government contributions, and investment returns. Let's break it down so you can get a better idea of what to expect.

Worst Performing KiwiSaver Funds going into 2025

We highlight the three worst-performing KiwiSaver funds in each multi-sector category based on their most recent 5-year average performances as at 31 December 2024, after fees but before tax.

Why Small Caps Play a Big Role in Compound KiwiSaver Portfolios

Small-cap stocks represent smaller companies with market capitalisations typically below $2 billion. These businesses are often in the early stages of growth, offering unique products or services and operating in niche markets. While they may not yet have the scale or recognition of larger firms, small caps have historically demonstrated strong performance over time.

Best Performing KiwiSaver Funds going into 2025

Maximise your returns for retirement with Compound Wealth’s list of the best KiwiSaver funds in each category going in to 2025. We help you decide how to invest.

The Dangers of Default KiwiSaver Funds

If you signed up to KiwiSaver through your employer, there’s a good chance you were placed in a default fund. While default funds have their purpose, they might not be the best option for your financial future. Let’s look into why you should move from a default fund.

5 ways to Maximise Your KiwiSaver in 2025

The start of a new year is the perfect time to make a few financial resolutions. If you’re serious about growing your KiwiSaver balance, setting some smart goals now can pay off big time in the years ahead. The good news is, making the right changes doesn’t have to be complicated. Let’s dive into five resolutions that can help you maximise your KiwiSaver returns in 2025.

DIY KiwiSaver - Build a personalised strategy with professional guidance

At Compound Wealth, we have access to a new, low-cost, open-architecture KiwiSaver Scheme that gives you more control and flexibility on your retirement savings. With this unique offering, you have access to over 400 securities (ETF’s, funds, direct equities & bonds) allowing you to build your own investment portfolio that suits your goals, needs, and appetite for risk.

Best Performing KiwiSaver Providers and Funds 2024

Maximise your returns for retirement with Compound Wealth’s list of the best KiwiSaver funds in each category for 2024. We help you decide how to invest.

Retirement Planning & KiwiSaver Scenario | Video

Allow us to walk you through an example of live cashflow modelling, illustrating how we incorporate KiwiSaver and investment advice to help clients make informed decisions for a secure retirement.

The Value of Financial Advice

Financial advice can help you navigate key financial decisions, ensuring better long-term outcomes, greater financial security, and peace of mind.